Don't Overlook Travel Insurance: Protecting Your Journey and Peace of Mind

For many, travel is an investment in unforgettable experiences, from spiritual pilgrimages like Umrah to cultural adventures across new lands. Protecting this investment is not just about safeguarding finances; it's about ensuring peace of mind. Travel insurance acts as a crucial safety net, turning potential crises into manageable inconveniences.

This is especially true for complex trips like an Umrah Plus journey, which involves multiple countries, significant advance planning, and substantial physical activity. While the primary focus is spiritual fulfilment, having robust travel insurance means you can devote your full attention to the experience, knowing you're protected against the unexpected.

Why Travel Insurance is Non-Negotiable for Modern Travelers

Think of travel insurance as a shield against the unforeseen. It covers financial risks that can derail any trip, such as accidents, illnesses, missed flights, lost baggage, or even the need for emergency evacuation. For a trip as significant as Umrah, which involves large crowds and a physically demanding schedule, this protection is invaluable.

The core question to ask yourself is: Can I afford to lose the money I’ve prepaid for this trip, or cover potentially massive medical bills abroad? For most travelers, the answer is no. Travel insurance typically costs between 4% and 10% of your total trip cost , a relatively small price for significant financial protection and mental comfort.

The Special Case of Umrah Plus & the Saudi e-Visa Insurance

When traveling to Saudi Arabia for Umrah, insurance is part of the conversation from the very beginning.

- Mandatory, but Minimal Coverage: The Saudi government requires all visitors to have health insurance as a condition for the e-Visa. This mandatory policy, included in the visa fee, provides basic medical coverage, typically up to SAR 100,000 (approximately $27,000) for emergencies like hospital stays and accidents.

- Significant Coverage Gaps: While this basic insurance meets entry requirements, it has critical limitations. It generally does not cover trip cancellation, trip interruption, lost baggage, emergency evacuation, or travel delays. If you had to cancel your entire Umrah Plus trip due to an illness before departure, the basic visa insurance would not reimburse you for your lost flights and hotel bookings.

The table below highlights why supplementing the basic coverage is highly advisable for a worry-free journey.

| Coverage Feature | Basic Saudi e-Visa Insurance | Comprehensive Travel Insurance |

| Emergency Medical Treatment | ✅ Included, but limited (e.g., SAR 100,000) | ✅ Extensive (e.g., $50,000 - $1,000,000+) |

| Trip Cancellation/Interruption | ❌ Not covered | ✅ Covered (due to illness, family emergency, etc.) |

| Lost, Stolen, or Delayed Baggage | ❌ Not covered | ✅ Covered |

| Emergency Medical Evacuation | ❌ Typically not included | ✅ Included (can cost $100,000+ without insurance) |

| Travel Delays | ❌ Not covered | ✅ Reimbursement for additional expenses |

| 24/7 Emergency Assistance | ❌ Limited | ✅ Standard feature |

Key Protections for Your Umrah Plus Journey

A comprehensive policy offers layers of protection that are particularly relevant for a multi-country pilgrimage:

- Trip Cancellation and Interruption: This is one of the most valuable coverages. It reimburses your pre-paid, non-refundable expenses if you must cancel your trip before departure or cut it short for a covered reason, such as a sudden illness or a family emergency back home. This is crucial for protecting the significant investment in your Umrah Plus flights and accommodations.

- Emergency Medical Expenses: Your domestic health insurance, including Medicare, often provides little to no coverage outside your home country. Travel insurance ensures you can get quality medical care in Saudi Arabia or Turkey without facing overwhelming bills.

- Baggage Loss or Delay: Imagine your luggage, containing essential items and perhaps religious materials, being lost or delayed. Insurance can cover the cost of replacing necessary belongings, allowing you to continue your journey with minimal disruption.

- Travel Delay Coverage: Missed connections due to flight delays can create a domino effect of issues. This coverage provides reimbursement for additional expenses like meals and accommodation while you wait for the next available flight.

Exploring Your Options: Trip.com, Klook and Other Providers

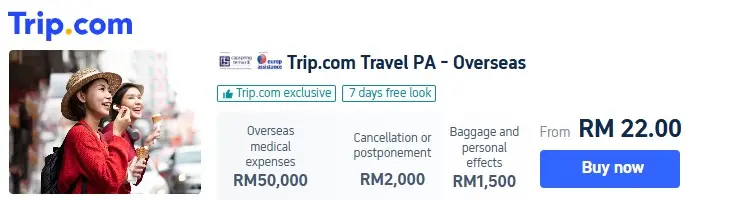

Many travelers find it convenient to arrange insurance through the same platforms they use to book flights and activities. The key is to compare the coverage limits and benefits carefully.

- Trip.com Insurance: Trip.com partners with major insurers like AXA to offer policies that can be easily added during checkout. Their plans typically include comprehensive coverage for medical emergencies, trip cancellation, and baggage. You can select a plan that covers your entire multi-destination journey.

- Klook Protect: Klook also offers travel insurance plans designed for modern travelers, often with affordable premiums starting from just a few dollars per day. Their policies generally cover overseas medical expenses, trip cancellation, and baggage delay. A useful feature for some plans is the option to add coverage for adventurous activities, which might be relevant for the hot air balloon segment in Cappadocia.

When comparing plans, look beyond the price. Check the maximum limits for medical coverage, the specific reasons covered for trip cancellation, and the deductibles. Reputable comparison sites like Squaremouth can also help you evaluate policies from various providers based on your specific needs.

Practical Advice for Travellers

✅ Always buy insurance before you travel – don’t wait until you’re already on the journey.

✅ Check coverage details – medical, baggage, trip cancellation, etc.

✅ Be clear about your destinations – if you’re going on Umrah Plus, make sure your insurance covers multi-country travel.

✅ Keep documents handy – policy number, emergency contact, and claims procedure.

Conclusion: A Small Step for a Safer Journey

Purchasing travel insurance is an act of responsibility towards yourself and your travel companions. For an Umrah Plus trip, it goes beyond financial prudence—it supports a peaceful and focused spiritual experience. By understanding the limitations of the basic Saudi visa insurance and investing in a comprehensive policy, you ensure that unforeseen events don't overshadow the profound purpose of your journey.

May your travels be safe, accepted, and filled with blessings.

Disclaimer: This article is for informational purposes only. The coverage, benefits, and exclusions of insurance policies can vary significantly between providers and change over time. It is essential to read the full terms and conditions of any insurance policy carefully before purchasing to ensure it meets your specific needs.

Leave a comment

Your email address will not be published. Required fields are marked *